Opinion

Op-Ed first published in the Wall Street Journal

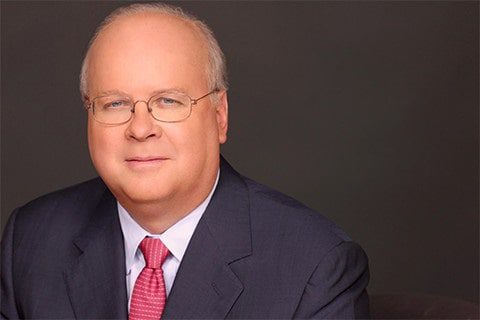

By Karl Rove

For someone leading others into an important political battle, Rep. Kevin Brady doesn’t cut an imposing figure. He’s more Omar Bradley than George Patton. But the soft-spoken, amiable former Ways and Means Committee chairman is an able commander of the House Republicans’ assault against the Biden tax plan.

The 66-year-old Texan distributed battle orders Tuesday at a House GOP Conference with seven pages of arguments for Republicans to use against the massive $2.1 trillion tax package passed out of committee last week by Ways and Means Chairman Richard Neal (D., Mass.).

Having long said he’d release the details as late as possible to minimize time for opposition to emerge, Mr. Neal knows he has concocted a plan that is dangerous to his party. Mr. Brady knows it’s also dangerous to America and offered material to House Republicans to make that case to voters.

Mr. Brady’s argument begins: Democrats want to give the U.S. one of the world’s highest corporate tax rates, higher than all our major economic competitors, including China. Cutting these rates in 2017 helped spur a strong pre-pandemic economy. Raising them now means we’ll “lose jobs to China, Russia, Europe and other countries,” Mr. Brady told reporters. “They’re going to clean our clock.”

The Texan also makes a convincing outline of how ordinary Americans—not billionaires—would pay most of the estimated $900 billion corporate tax hike through lower wages and benefits. The Congressional Joint Tax Committee backs him up, saying within 10 years, low- and moderate-income taxpayers will pay two-thirds of the corporate tax increase. Surprisingly, this view is shared by the left-wing Tax Policy Center, which says President Biden’s plan would raise taxes on 75% of middle-class families within a year and 95% over the decade.

Further, Mr. Brady reminded the House GOP Conference that small businesses are getting back on their feet just in time for Democrats to slap them down. The tax bill would be especially hard on the millions of small enterprises that are pass-throughs, filing on the personal tax schedule rather than the corporate one. They’d pay as much as 39.6% on profits and 25% on capital gains, while seeing their 20% small-business deduction severely limited. They’d also get slapped with a “net investment tax” of 3.8% and see death-tax exemptions for their family-owned businesses, ranches and farms slashed.

Another part of his argument: Low- and middle-income Americans would be socked with higher utility bills and gasoline prices by Democratic taxes on energy production, whose purpose is to raise the cost of energy from hydrocarbons. This would make buying from U.S. oil and gas producers costlier than purchasing energy from foreign countries which don’t have America’s exacting environmental standards.

House Democrats would also impose price controls on drugs, which Mr. Brady argues would reduce research and development of lifesaving pharmaceuticals. This proposal was too much for a few centrist Democrats, who blocked it in committee, though Speaker Nancy Pelosi vows to resuscitate it.

Mr. Brady also drew his Republican colleagues’ attention to the Democratic proposal to create of a huge universal paid medical and family leave entitlement. For companies that offer such programs today, taxpayers would pick up the tab for 90% of the cost while small businesses would have to start offering such benefits as well, whether they could afford the costs or not.

Op-Ed by Mr. Rove courtesy of rove.com

Karl Rove served as Senior Advisor to President George W. Bush from 2000–2007 and Deputy Chief of Staff from 2004–2007. At the White House he oversaw the Offices of Strategic Initiatives, Political Affairs, Public Liaison, and Intergovernmental Affairs and was Deputy Chief of Staff for Policy, coordinating the White House policy-making process.

Mr. Rove has been described by respected author and columnist Michael Barone in U.S. News & World Report as “…unique…no Presidential appointee has ever had such a strong influence on politics and policy, and none is likely to do so again anytime soon.” Washington Post columnist David Broder has called Mr. Rove a master political strategist whose “game has always been long term…and he plays it with an intensity and attention to detail that few can match.” Fred Barnes, executive editor of The Weekly Standard, has called Mr. Rove “the greatest political mind of his generation and probably of any generation. He knows history, understands the moods of the public, and is a visionary on matters of public policy.”

Before Mr. Rove became known as “The Architect” of President Bush’s 2000 and 2004 campaigns, he was president of Karl Rove + Company, an Austin-based public affairs firm that worked for Republican candidates, non-partisan causes, and non-profit groups. His clients included over 75 Republican U.S. Senate, Congressional, and gubernatorial candidates in 24 states, as well as the Moderate Party of Sweden.